I discovered two highly disparate figures while analyzing the monitoring reports (UNIC and EAO) that annually publish data on the state of world cinema markets. First, it is encouraging that many markets have reported that overall cinema attendance in 2022 has already recovered by two-thirds (to the pre-COVID levels). Meanwhile, it is disappointing that the Ukrainian market has collapsed to the level of 2005 (9 mln tickets, $37 mln revenue). Just in the days when this information was occupying my attention, news broke of a draft law that envisaged a switch to showing English-language films in their original language (with subtitles). Market players have already voiced their concerns on this matter, and I will join them in presenting my opinion against the background of a brief overview of the current state of the world film industry and the position that our country has been taking in its context for the last 25 years.

Beginning

The first modernized cinema (Kinopalaсе) opened its doors in Ukraine on May 1, 1998, which can be regarded as ushering in a new era of film exhibition in our country. Over time, the number of films distributed in our market has increased (their premieres were increasingly synchronized with world premieres). Box-office receipts increased from year to year, mainly due to the opening of new cinemas and the expansion of the repertoire (including the impact of big blockbusters - the "ice-breakers" of emerging markets). Ukraine was becoming a country with an observеd market space in the film industry segment. The market share of Kinopalaсе (later it became a cinema chain) was still at 60-85% of total box-office receipts for a few years. Later, however, the revenues of other market players increased, and their combined size and growth rates gradually reached a level where one could conclude the prospects of the emerging market space. Сomparing Ukrainian results to those of other markets in 1998 was difficult and much less encouraging. Box office revenue for "Titanic" was unprecedentedly high, but even against this backdrop, distributors were not optimistic. American films were released in the Russian language everywhere in the CIS, even if a Ukrainian distributor had a direct contract with an American rights holder. The films were still distributed in Russian because it was conventionally regarded as a single market. Many commercially strong releases had to be released with subtitles because there were great fears that distribution revenues, even in several countries of CIS, would not return the costs of dubbing. Thus, blockbusters like «Saving Private Ryan» and «American Beauty» were released with subtitles. In 2001, the Ukrainian distribution company “1+1 Cinema” released the Polish blockbuster film “With Fire and Sword” (dir. by E. Hoffman, starring Bohdan Stupka (No.1 actor in Ukraine) and Ruslana Pysanka (TV star)). Even though this film had a record result in its home country (7.1 mln admissions), the distributor still did not dare to spend money on dubbing (later, despite the unprecedented advertising support of the 1+1 TV channel, many cinemas refused to show this film because it was subtitled). The market was so weak that we had to act cautiously, even when distributing blockbusters. Only after upgrading a number of cinemas and opening the first Multiplexes has it become clear that mass film visits will resume in our country, and not only in the capital.

With hundreds of new cinemas opening in Ukraine in 2012, gross box-office receipts in our country have exceeded $100 mln, and Ukraine has taken its rightful place on the global box-office map. Today, in 2023, Ukraine has comparatively worse performance only due to the war (which started affecting it in 2014). Still, as the following statistics will show, the Ukrainian market had every chance to prove itself as the second (after Poland) Eastern European market, whose potential would have allowed it to release up to 20 home-produced films a year, with a significant part of the costs recovered from box office revenues. Such conclusions can be drawn by looking at the revenue growth dynamics of Ukrainian cinemas up to 2013. Let's compare the Ukrainian figures with markets in other countries and adjust these figures for local specifics. We can say that in 2019 the capacity of the Ukrainian market would have reached the $200mln. However, the Ukrainian market was only $114 mln that year and collapsed to $64 mln in 2021. In 2022, the box office of Ukrainian cinemas was already $33mln, and the results in 2023 seem to be only marginally better. Thus, what did we have in our market, and what could we have had but couldn’t because of the well-known events?

World Film Market. Key Trends

Favorite Genres of the Contemporary Moviegoer

By sheer coincidence, the beginning of a new era of film screening in Ukraine coincided with the release of «Titanic» - an event which, like the subsequent release of several major blockbusters, has intensified markets. However, one of the critical trends for the period under review will be that among the genres that make box-office in the tone-setting US, films in the Drama genre will move from 1st place to 3rd (sometimes 4th and even 5th). The dynamics of films in the Adventure and Action genres are very different (in the simplified classification suggested by The Numbers, as you can't count «Titanic» as a drama alone). Since 2014, Adventure and Action films have grossed over 50% of the North American market, and the same US films are the box-office leaders in the rest of the world. It should be noted that films in these genres do not take by numbers: year after year, 2-2.5 times as many Drama films are released in the US as Adventure and Action, but their combined grosses in this market have rarely ever exceeded 13-14%, and due to the pandemic, their share has dropped to 5-8%, while Adventure and Action have risen to 70% (in the first half of 2023). These proportions are nowhere to be found in such contrasting correlations. European box-office films tend to be dramas or comedies. What is certain, however, is that American films currently account for the lion's share of the global box office, with Adventure and Action occupying the leading position. Thus, nowadays, viewing a film (in 2 out of 3 cases) is watching a visual attraction. The moviegoer today is mainly an observer of an attraction in which they participate not physically but with their attention and game of the imagination. This trend is quite evident and global. For that reason, the creators of modern affecting spectacles, such as the American blockbuster today, are increasingly adopting the arsenal of circus performance, comic books (with their illustrative simplicity), and computer games (with their paradoxical intrigue); the role of expressive means borrowed from theatre and literature has been declining in recent decades. The role of film stars is diminishing, giving way to visual and sound effects. One of the newly appeared cinematic attractions is 3D films. In our context, it is essential to note that the explosive demand (as well as production - over 50 titles a year) for films in this format has almost come to naught: while in the early years of the boom (immediately after the release of «Avatar») cinema box-office sometimes consisted of one-third of the income from the distribution of such films, but now their share has dropped to 4-5%. One (but certainly not the only) reason for this phenomenon is the unwillingness of viewers (despite the obvious pleasure they get from watching a film in a large format) to experience additional strain on their eyesight and brain.

National Film Production and Distribution

There are 13 countries in Europe in which the box-office revenue of national films account for the fifth and most of revenues from general cash register (2022): France (41%), the Czech Republic (34%), the UK (30%), Germany (27%), Denmark (26%), Finland (25%), Norway (23%), Spain (22%), Italy (20%), Estonia (20%), Poland (21%, but before the pandemic, in 2019, the figure was 28%), and Lithuania (20%). Latvia accounted for 20% in 2019.

The leader in European film production is also France: 287 films (2022), 340 (2021), 183 (1998). The other countries in this leading European group had the following production figures for their own films in 2022: the Czech Republic (96), the UK (220, in 2019 - 378), Denmark (54), Germany (198, incl. 113 excl. German films), Finland (40), Norway (25), Spain (313, incl. 244 excl. Spanish films), Italy (357, incl. 294 excl. Italian films), and Poland (85). Film production in these countries has grown three or five times in the last 25 years. 25-50 films a year are produced even in countries where the local product does not have such a high share in total revenues. The markets of Estonia (2019: box office = $24.4 million, share of national films = 23%), Lithuania (2019: box office = $25 million, share of national films = 19%), and Latvia (2019: box office = $16.8 million, share of national films = 20%) are worth paying particular attention to. These countries produce around 25 (and more) films annually, but their markets are still smaller than in Ukraine. Slovenia (population = 2,1 mln, the market capacity = $12.1mln) also releases 20 films annually, with a record market share of 14.4% last year.

Box-office

The worldwide box office reached $25.9 bln (4.3 bln admissions) in 2022. In 2019, the box office amounted to $42.39 bln (7.56 bln admissions). The pandemic has 'hamstrung' the global market by 62% (2020/2019).

Nowadays, the US and Canadian markets account for 26.8% of the global box office, whereas in 2006, for example, the North American market accounted for 45% of the global market. Thus, the foreign box office of US films (especially blockbusters) has grown significantly in recent years.

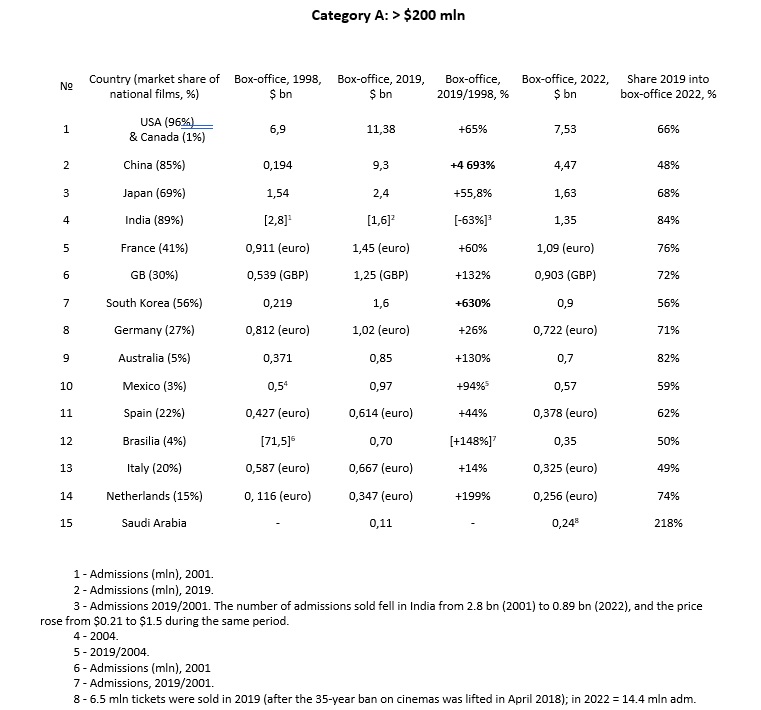

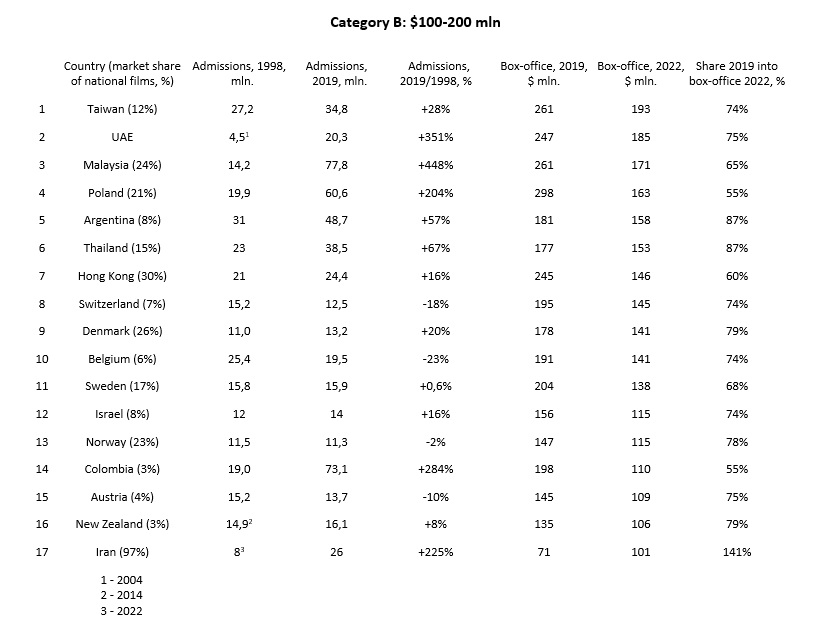

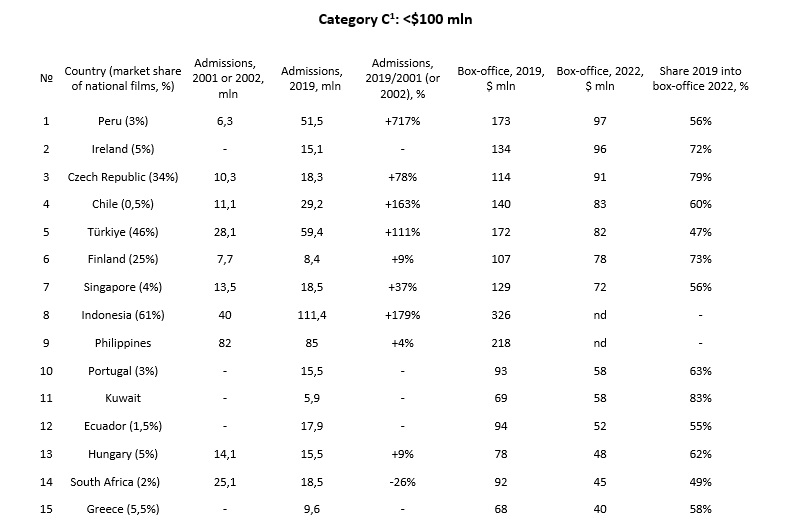

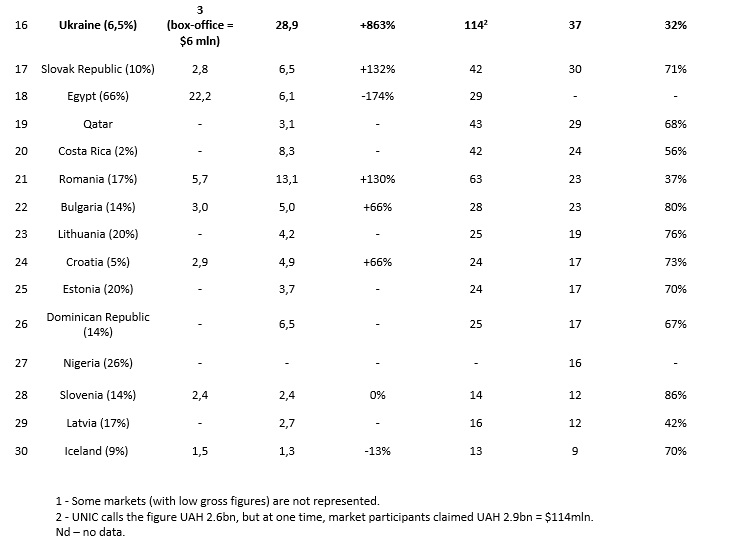

The tables below provide data on gross revenues and admission sales worldwide. The positive trend was observed in them only before the COVID-19 pandemic broke out, and comparative data are presented for 1998-2019, i.e., the last year before the pandemic and in 2022/2019. All markets are split into three categories: Category A (over $200 mln), Category B (between $100- $200 mln), and Category C (up to $100 mln). The data has been reduced where necessary.

The world's leading film markets tend to be densely populated countries. The markets in this group hold leading positions due to a combination of factors, including high attendance, ever-increasing ticket prices, and a high population size. Whenever the attendance in a particular market has fallen over the period (its average value per inhabitant) and the market has nevertheless grown, this has most often happened (but not in South Korea, Germany, Italy, and Spain) against the background of the population growth (by 15-20% on average, in India by 40%).

The roughly equal markets of the Netherlands and Saudi Arabia (SA) have fundamentally different starting points: the Netherlands has 3.5 times higher attendance, and SA has 55% more expensive tickets ($10.9 and $16.9). The explosive growth figures for the Chinese and South Korean markets are also worth noting because Ukraine was, until recently, among the countries with such tremendous growth.

The list of "big" markets has also recently included Indonesia, whose 2019 box-office = $326 mln.

The other major market to drop out of the top group is Turkey. Its market was worth $239 mln in 2017 but then began to decline due to the depreciation of the local currency. Cinema attendance remained flat at more than 70 mln tickets per year. Subsequently, due to the pandemic, attendance at Turkish cinemas halved, and the country's market was among those with revenues below $100 mln per year (the revenues in 2023 show that Turkey will return to the group of leading film markets).

National films hold a dominant position in five major markets: the US (96%), India (88%), China (85%), Japan (69%), and South Korea (56%).

Five countries, whose markets were not so prominent 25 years ago, are at the top of Group B (to these five - Taiwan, UAE, Malaysia, Hong Kong, and Thailand - we should add Saudi Arabia, number 15 in Group A).

The impressive success of nearby Poland, whose market in 2019 almost reached $300 mln, points once again to what Ukraine could have achieved: Poland has entered such a boх-office with a much higher screen density (37 screens per 1 mln people) than Ukraine. In Ukraine, this figure is 15, which is 3-4 times lower than in Hungary, Croatia, the Czech Republic, or Slovakia and 5-8 times lower than in Western European countries (i.e., our market had relatively good results without being fully equipped with the optimal number of screens). Among the former Soviet republics, Estonia has the highest density of cinemas: 70,7 screens per 1 mln people (this is even higher than in Great Britain (69,8), Germany (59), or Italy (57,8) but lower than in France (92,9). At the same time, it should be noted that the processes in one of the markets, despite its adjacency, should not be compared with those in the other. The market space is always specific. With almost the same screen density in the Czech and Slovak markets, attendance differs almost twice in favor of the Czech Republic. It is evident here that there is a difference in the amount of national production: the Czech Republic's production volume and national market share are 3-4 times higher than in Slovakia.

Peru led the third group of film markets in 2022 (ticket growth was +717%). It is a high figure. It is rare when the dynamics in the number of tickets sold is measured by a hundred percent, especially for the markets with such low profits. But it should not be forgotten that in this country, the population increased by 8 million people in the same years, while in Ukraine, it decreased by approximately the same amount over the same period. China's population grew by 14% between 1998 and 2021 (ticket growth of +1400%, box office growth of +4,693%), so the high figures for this market are unrelated to the population growth. Another world leader, South Korea, has grown from 50.2 mln tickets sold to 226.7 mln (+351%) while its population has increased by 11.7% (2019/1998). As a result, the box office of this market grew by as much as 630%. It is a significant figure, but in Ukraine (in relative terms and dollar equivalent), it is even bigger = +1800% ($6 mln in 2001 and about $114 mln in 2019). Having excluded Russia from our comprehensive analysis, we can see that the Ukrainian film market has had positive trends (in relative terms) which are comparable only to what has been seen in China and Indonesia (there are no exact figures for this country, but it is likely that between 1998 and 2019, its market grew by almost 30 times). The data for Ukraine are not accurate (especially in dollar equivalent). Still, under any adjustment, the Ukrainian market and its dynamics would not look fundamentally different during the period in question.

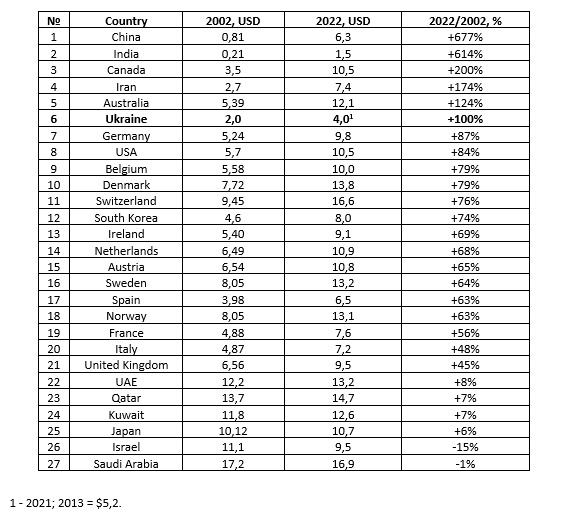

Average Ticket Price

Market growth is closely correlated with increases in ticket prices. However, when looking at long-term periods, sometimes a sharp increase in ticket prices is first followed by a leveling out or even an increase in the market and then a decrease, which is probably to some extent due to the rise in ticket prices that was undertaken in the previous period. The table below provides selective data on the evolution of ticket prices in some countries. There is no doubt that ticket prices in global markets are generally increasing, but this process is rather heterogeneous.

If compared with GDP per inhabitant, the ticket price in Ukraine is the most expensive in Europe. In 2022 the ticket price (before the start of the war) increased again and was approximately $4,2 - 4,3, but in the second half of the year, it dropped by 10-15%. In 2023 the average ticket price raised again: 'Avatar: Way Water" = 166 UAH, "Luxembourg, Luxembourg" = 149 UAH, "Pamphir" = 140 UAH, “Mavka” = 120 UAH. It is difficult to predict the final result of 2023, particularly its dollar equivalent, but it is clear that our market is working at maximum capacity.

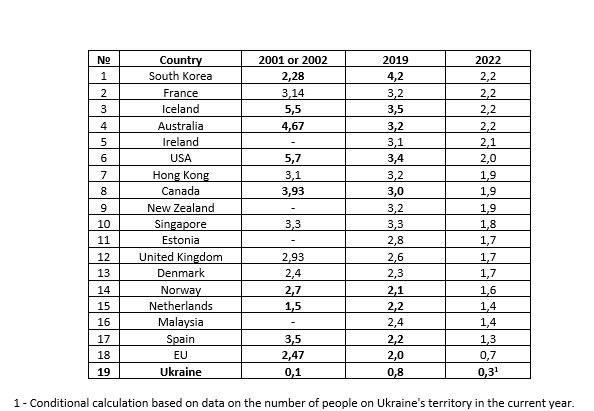

Average admissions per capita

One of the critical indicators of the cinema market is average admissions per capita. This figure is higher than '2' for a tiny group of countries (and these are all countries except Malaysia with GDP (PPP) per capita >$45k). Attendance (among big markets) per capita increased significantly only in South Korea and the Netherlands, while the US figure decreased by 40% (2019/2001).

In 2019 attendance in Poland was = 1.6 (in 2022 = 1.1), while in Ukraine, this figure was rarely higher than 0.8 in the best years. There is no reason to expect that attendance will somehow rise in Ukraine now. At best, it will return to pre-pandemic levels. Perhaps one day, we will have attendance in our country (in the long-term) similar to what we had before the pandemic in Eastern European countries (1.2-1.7). If we want to have attendance at the same level as, for instance, in Estonia (2.8 in 2019), we will have to remember that this is due to the production of 20-25 national films a year and the screen density, which is 5 times higher than ours.

Digitalization. Total Production Volumes. Multiplexes

During this period, film screening has gone almost entirely to digital format (though few people could predict it). Nowadays, films are shown on 212,000 screens in the world, 42,000 of them are in North America, and 43,000 - in Europe (including Turkey and Russia). The number of screens in Ukrainian cinemas is 663 (as of December 2021). Digitalization has had a fundamental impact on the expansion of film distribution. Previously, cinemas in smaller towns could not distribute films on the first screen. This possibility was linked to the minimum guarantee, which depended, among other things, on the cost of printing a 35mm film copy and was often more significant than the likely revenue.

Multiplex cinemas earn the majority of revenue. The largest operators of the market are multiplex chains (the “Multiplex” and “Planeta Kino” collect a combined total of about 50% of all Ukrainian revenues).

About 8,000-9,000 films are produced yearly in the professional film industry. India is considered the largest producer (up to 2,500 films annually; US = about 800, China = about 1,000). Having declined during the pandemic, global film production recovered by 92.4% in 2022, but the production of most projects in Ukraine has been completely suspended.

The Ukrainian Film Market and the Prospect of Linguistic Modernization

According to the overview of the world film market development, we can see that the Ukrainian market has had one of the best dynamics in the world. At the moment, however, our film industry is not having the best times. While most countries can reach the 2019 figures in the near future, it is unlikely to happen in Ukraine: our boх-office in 2022 was 32% of that in 2019. It is the worst result in the world today. It is not fully connected with the pandemic consequences. The results of 2023 may be slightly better than those of 2022. Still, even if they are fundamentally better than those of 2022, another result is much more important: the success of «Mavka» (152,6 mln UAH), «Luxembourg, Luxembourg» (34 mln UAH), and «Pamphir» (11,4 mln UAH). The share of domestic films in the box office will be record-high (in the first five months of 2023, it equals about 25%). To this should be added the total worldwide box-office results of «Mavka»: it was about $12.9 mln (for any Eastern European film to collect such a sum is a unique phenomenon).

One more figure for comparison: the distribution of a successful French-Belgian animated cartoon, "Chicken Hare and the Hamster of Darkness" (2022), earned $10.8 mln.

Ukrainian films have shown decent boх-office, and it is worth noting that this happened under extreme conditions. Such results hint at the direction in which government actions can have a win-win outcome, regardless of any political context. Such a market would most likely need protectionist measures. At the very least, we can discuss additional measures to stimulate national production. However, the least such measure is a bill submitted to the Parliament on the transition to screening English-language films in their original language with subtitles.

If such reform is implemented, some audiences may stop going to the movies (or go much less often). Who are these people? It seems to me that they are:

- Children who can't yet read;

- Elderly (due to the additional strain on their eyesight);

- Children of primary and secondary school age (due to their inability to concentrate on reading subtitles for more than 45 minutes);

- Viewers of other ages (those who initially would not be satisfied with the additional strain on their eyesight);

- Viewers who will make trial attempts, the results of which will not satisfy them (a viewer will check on their own experience that it is rather difficult to watch the film and read the text simultaneously; moreover, it reduces the quality of an impression from a film). People go to see a film as a spectacle which is the key trend of the modern movie industry, with the identification of which we have begun our review.

Of course, in the very distant future, probably measured in decades, a new generation of Ukrainian people will grow up and will be able to watch English-language films in the original language as quickly as they do in some Western countries. However, this will not happen overnight, and we will face problems, one way or another, especially at the start. Considering that we have already had a relatively strong tradition of watching foreign films in a dubbed form, we will probably face a chain reaction of several issues, the negative consequences of which cannot be commensurate with the possible benefits.